BEAR MARKET GUIDE

Apr 05, 2025

Hello Everyone 👋 Welcome to Iceberg Trading—I'm Bojan, and I'm excited you're here!

At Iceberg Trading, we're committed to empowering investors and traders with essential knowledge, strategies, and market insights to enhance your trading and investing success.

Today, we're diving deep into one of the most crucial topics you'll encounter in your investing journey—Bear Markets.

Understanding how bear markets work, why they occur, and how to navigate them effectively can transform market downturns into significant profit opportunities for you.

In this comprehensive guide, you'll learn everything you need to confidently handle bear markets, protect your portfolio, and strategically profit from declining prices.

We'll extensively explore:

-

What precisely defines a Bear Market, along with its detailed characteristics.

-

Effective strategies for anticipating and preparing for bear markets.

-

How to profit strategically during periods when markets are falling.

-

The four distinct stages of bear markets, helping you recognize exactly where the market stands.

-

Essential methods to protect your portfolio and take advantage of undervalued investment opportunities.

-

Real-world examples from recent bear markets, offering practical insights into market dynamics.

Let's jump right in and start your journey toward mastering bear markets!

Defining a Bear Market

Officially, a bear market is defined as a period when market prices decline by 20% or more from recent highs. It's marked by intense selling pressure, widespread pessimism, increased volatility, and fear-driven market behaviour.

These downturns typically don't happen in straight lines; instead, they are characterized by sharp declines followed by brief recoveries, adding layers of complexity to trading and investment strategies.

A clear example of a bear market occurred in 2022, notably impacting technology-heavy indices like the NASDAQ, which fell over 30% from its peak. This downturn was driven by rising interest rates, disappointing earnings reports from key technology companies, and geopolitical tensions stemming from the Russia-Ukraine conflict. These factors combined created a perfect storm of market uncertainty and widespread selling.

(QQQ Monthly Chart - Showing the 2022 Bear Market)

Types of Bear Markets

There are 2 types of Bear Markets:

Cyclical Bear Markets

These bear markets typically last several weeks to months and often represent significant corrections within broader bullish trends.

For example, the 2020 COVID-19 market crash led to major indices such as the S&P 500 and NASDAQ declining by over 30%, primarily due to fears related to a global pandemic.

(SPY Daily Chart - Showing the 2020 COVID-19 Bear Market)

Secular Bear Markets

These bear markets last considerably longer, often spanning several years. They usually stem from fundamental economic issues or prolonged periods of economic adversity.

Historical examples include the Dotcom bubble burst (2000-2002) and the Global Financial Crisis (2007-2009), both causing substantial, prolonged downturns.

(SPY Weekly Chart - Showing the 2008 Global Financial Crisis Bear Market )

Historic Bear Markets

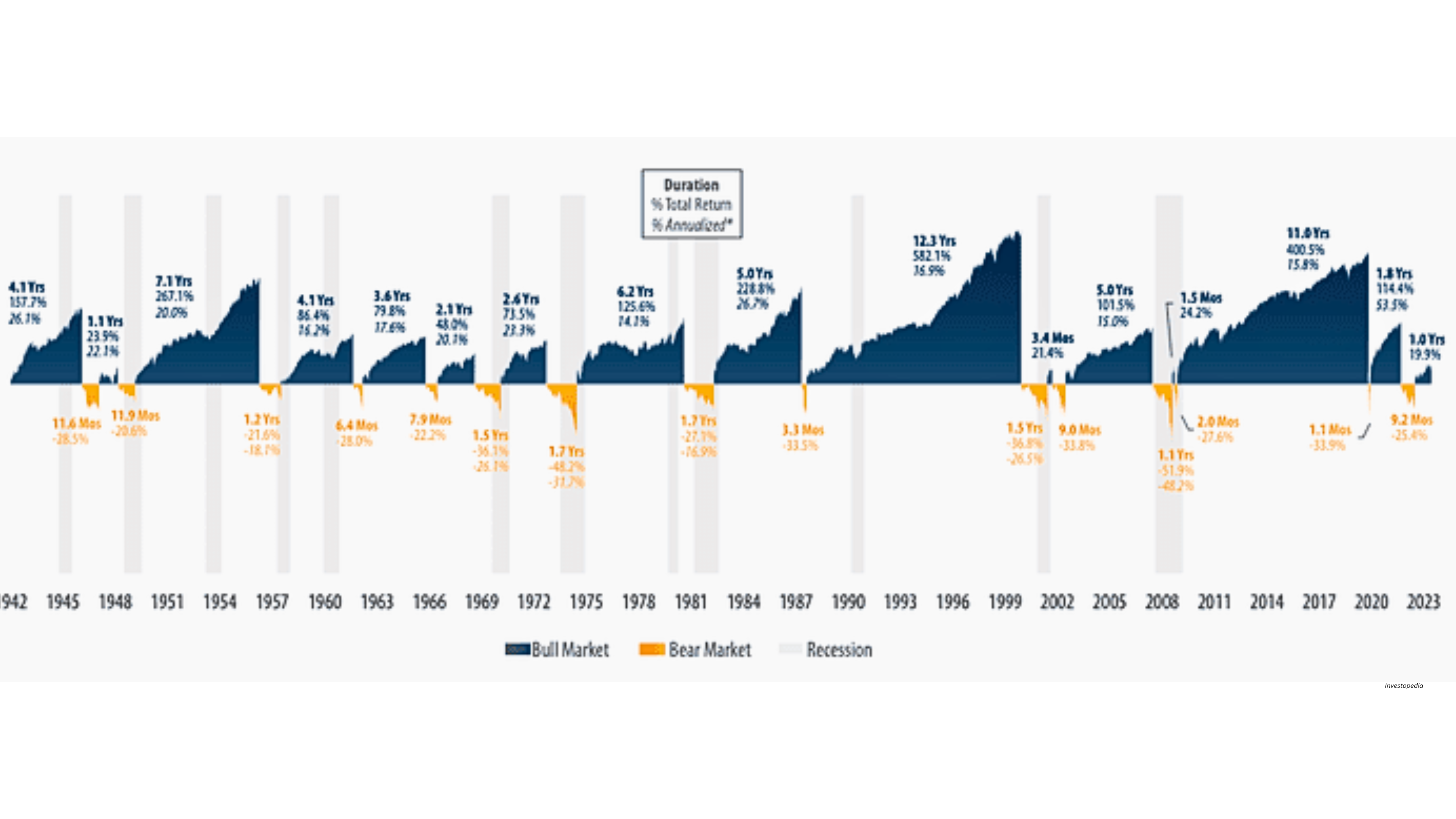

Throughout stock market history (over the past 120 years), cumulative data reveals approximately 105 years of bull markets (periods of aggressive price appreciation), with the average bull market lasting around 7.6 years.

Conversely, bear markets (periods of aggressive price declines) have cumulatively lasted around 15 years. Historically, the average bear market lasts about 1.2 years (approximately 14 months), occurring roughly every 3.6 years.

While the frequency and duration of bear markets can vary significantly depending on economic conditions and market dynamics, these averages help investors set realistic expectations and prepare strategic responses when navigating market downturns.

Understanding these historical patterns provides valuable context and insight, enhancing an investor's ability to manage risk and capitalize on emerging opportunities.

Profiting in a Bear Market

During Bear Markets, prices move in a downtrend motion, making lower highs and lower lows.

Short-Term Trading Strategies

-

Short Selling: Traders profit by borrowing and selling securities at high prices, then buying them back later at lower prices, profiting directly from market declines.

-

Buying Put Options: Traders leverage put options to profit from anticipated sharp declines, taking advantage of heightened market volatility.

-

Buying Inverse ETFs: These ETFs rise when the market indices fall, providing straightforward bearish exposure.

-

VIX Trading: Known as the "Fear Index," the VIX reflects market volatility. Traders can profit significantly by trading options on the VIX, particularly during periods of rapid market declines and spikes in volatility.

Long-Term Investing Strategies

-

Accumulating Undervalued Shares: Bear markets provide long-term investors an exceptional opportunity to buy high-quality, financially stable companies at deeply discounted prices, often significantly below intrinsic or fair value.

-

Position Averaging: Investors use this approach to systematically invest fixed amounts at regular intervals, buying more shares as prices decline, ultimately lowering their average cost per share. With this approach it is essential to accumulate only when the price reached major pivotal support points.

The above 2 approaches allow investors to take advantage of the rebound and future change in trend to a more bullish momentum.

-

Portfolio Hedging: For investors who are not looking to buy more shares, as they likely have all their capital already allocated, they can protect their existing portfolio by hedging it with put option strategies.

Investors utilize put options strategically to hedge and mitigate potential losses in existing portfolio positions during downturns.

Bear Markets Explained

Stock Prices Decreasing

At the beginning of and throughout the bear market prices are on a downtrend and decreasing.

Now it’s important to remember that nothing drops in a straight line, rather stock prices move in waves. This means that they are making lower highs and lower lows.

Aggressive selloffs during the bear markets are induced by selling due to fear of losses, forceful liquidations and short sellers taking new positions. These send prices crashing and breaching support levels.

Company Growth Decreasing Leads to Fear & Selloffs

During the bear market, as the companies report lower growth expectations, lower than expected EPS and Revenue, combined with decreasing Cashflows, investors get fearful and begin selling shares.

Institutions start offloading large quantities and aggressively driving the prices down. This creates even more panic between retail investors and the selloff amplifies.

Pullbacks & Corrections vs Bear Markets

It is important the distinguish between Pullbacks which are defined by price declines of 1-10%,

Corrections which are price declines of 10-20%, and Bear Markets which are declines of 20% or more.

Pullbacks and Corrections provide the “buy the dip” opportunities, while Bear Market price action is seen as a “falling knife”.

As we all know the best things to do with a “falling knife” is to let it drop and hit the ground then pick it up! Do not try to catch it in mid air.

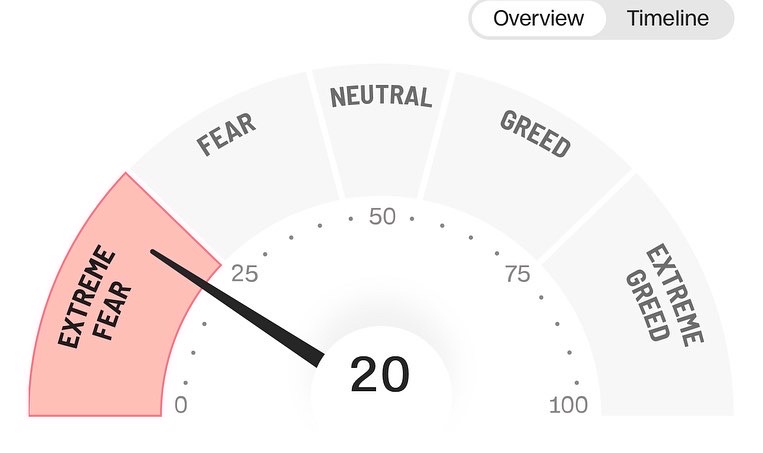

Risk Tolerance of Investors

During the bear markets, investors are often risk averse, and are not seeking new risks. At these times we tend to see lower trading volumes as investors and traders are more cautious of the market behaviour due to fear of loss.

Risk is further avoided due to the prevailing fear sentiment in the markets.

All these factors can lead to aggressive selling, as institutional investors start offloading their shares, followed by retail investors which further contribute to price decline and cause mass position exits in the markets.

In addition due to rapid price decline, many investors and traders face margin calls, where they are forced to sell their stocks at the lowest prices, which can further contribute to aggressive price decreases.

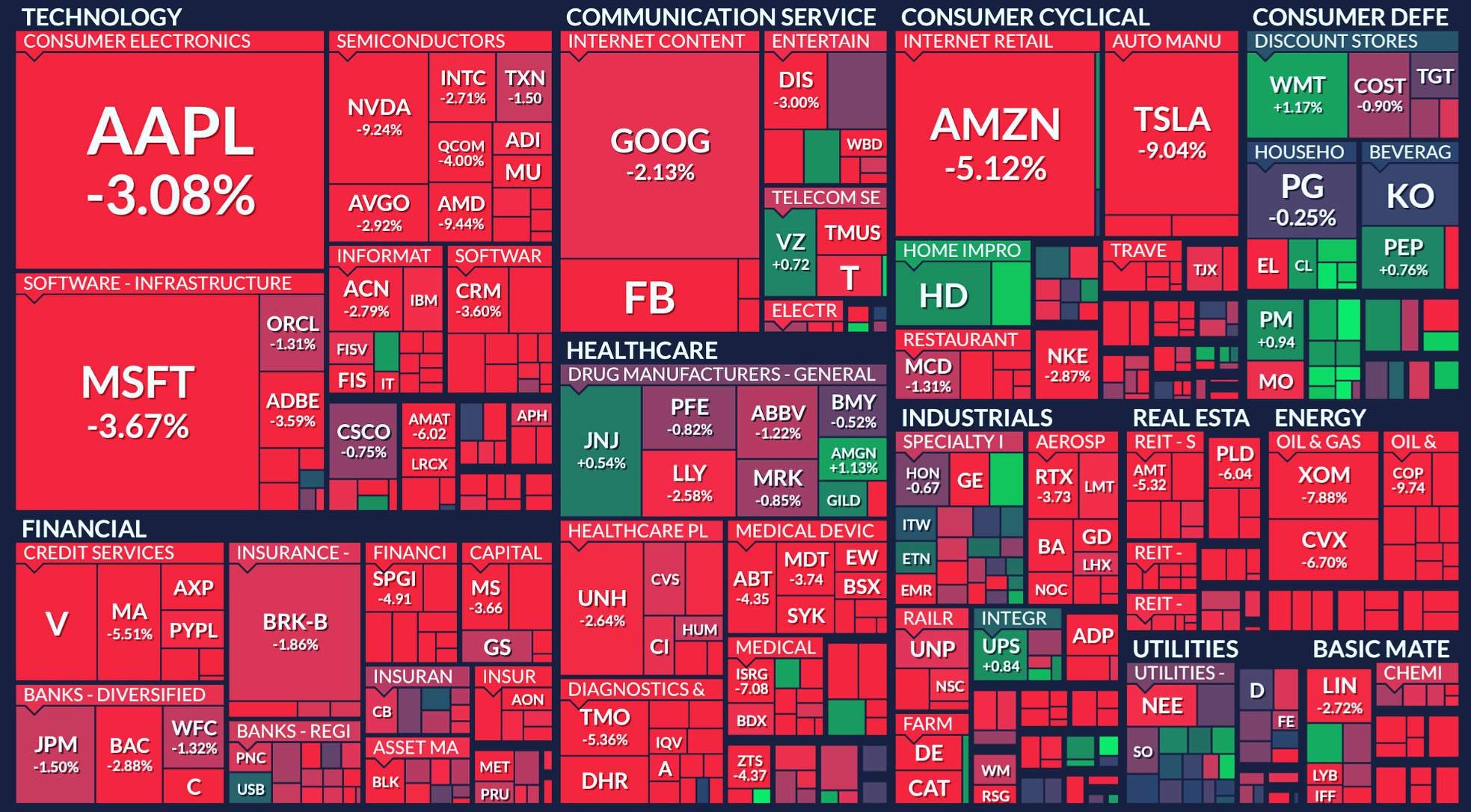

Defensive, Not Speculative Stocks

Due to high risk and fear in the markets, investors tend to rotate to Defensive stocks that have low volatility and can withstand turbulent markets.

Often these companies provide day to day necessity type of products and services for most people, like medicine, toothpaste, shampoo, beverages etc. These companies include JNJ, PG, KMB, WMT, PEP, KO and many more.

In addition to safe haven like environments, these companies also pay a steady dividend to shareholders which further boosts investor returns.

The price appreciation is not as aggressive as it would be in a tech or growth company, but it sill usually on average 8-13% per year.

With defensive portfolios we often get the luxury of withstanding any type of market conditions and protect our capital. Often the returns from defensive companies end up positive for the year, even during bear markets.

S&P500 Performance Map

The 4 Stages of a Bear Market

Stage 1: Market Peak – Optimism and Greed

At this stage, the market reaches peak optimism, characterized by excessively high valuations, widespread investor enthusiasm, unsustainable levels of greed and FOMO (Fear of Missing Out). Prices are typically driven beyond rational valuations, often detached from fundamental realities.

Stage 2: Decline – Fear and Panic Selling

Prices begin their downward journey as optimism fades, triggered by disappointing corporate earnings, negative economic indicators, or external shocks. Confidence evaporates rapidly, resulting in aggressive selling from both institutions and retail investors. Prices breach critical support levels, intensifying panic.

Stage 3: Capitulation – Market Bottom

The market experiences maximum fear and pessimism. This stage is characterized by panic-driven selling climax, where the remaining sellers finally exit their positions at significant losses. Eventually, selling pressure diminishes, stabilizing prices at lower levels. Cautious buyers start returning, seeking undervalued assets.

Stage 4: Recovery – Beginning of the Bull Market

Investor sentiment begins improving, with institutions and informed investors stepping in to buy undervalued securities, attracted by the compelling valuations. Gradually, confidence returns to the market, trading volumes increase, and prices start trending upwards consistently, signaling the onset of a new bull market.

4 Stages of a Bear Market

What Causes Bear Markets?

There are several common causes of bear markets, and the more of them occur the more likely is it to lead to a bear market. With that being said just because these things happen does not necessarily mean we are going to enter a bear market. The most common reasons are as follows:

Weak & Slowing Economy

We see the economic performance of the country starting to fall and KPIs are often turning from positive growth to diminishing growth or negative. The most common things we see are low employment levels, low disposable income of the general population, weak productivity and drop in company earnings.

Bursting Market Bubbles

Market bubbles get created when many companies usually within a particular sector become extremely overvalued and their stock prices reach all time new highs never seen before.

We often see these stock prices move up in a 90 degree manner, sometimes in a straight line uptrend (this is called a parabolic movement).

What creates the bubble, is the fact that these companies have no justification that supports their extremely high prices and overstretched valuations. Usually these businesses are NOT financially healthy or consistently profitable.

These securities tend to be of a speculative nature and are not clear market or sector leaders in their industry.

We saw these stocks rise in value in 2020/2021, then crash at the beginning of 2022. Some examples include: Meme Stocks, DOCU, TDOC, ARKK etc. In 2024 we saw many AI startups, space related companies and others like PLTR.

Pandemics & Geopolitical Crisis

These phenomenons can often cause a bear market. We saw in March of 2020 what the COVID pandemic did to the markets. It caused one of the quickest bear markets in the history with a drop of 35.5%.

Geopolitical tensions and pandemics can cause rapid degradation of economic well being. They usually disrupt the day to day operations of businesses and create fear sentiment with induced aggressive selling in the markets.

Wars & Trade Conflicts

At the beginning of 2022 Russia invaded Ukraine, which had a negative effect on the market's well being and caused market prices to decline. Certain commodities however, like oil and energy skyrocketed.

We also saw at the end of 2018 what the trade conflict between US and China did to the markets. During this time the SPX dropped by 21%, NASDAQ by 24% and DOW JONES by 20%. We are seeing the same issue unfold in 2025.

These events tend to interrupt the international trade, supply chains and increase the costs of goods sold to the general public.

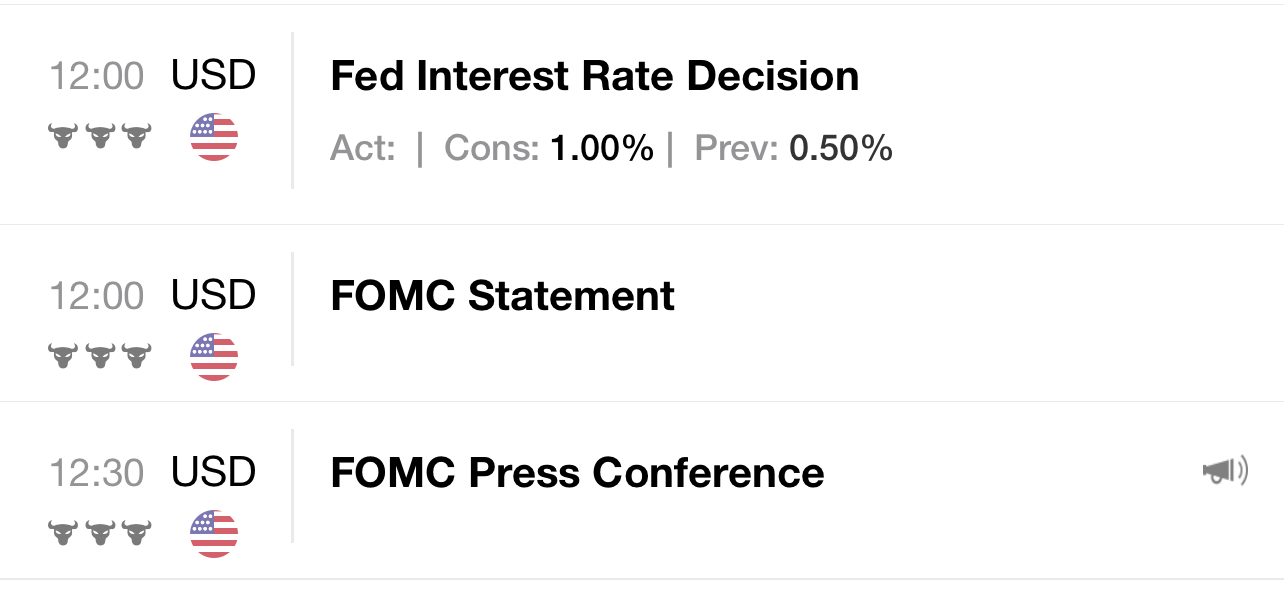

Government Intervention in the Economy

This is another major potential cause of bear markets. We seen governments having to get involved and stimulate economies around the globe after the COVID 19 pandemic. The US government printed more money than ever before in history during this time. This was one of the main reasons for the extremely high inflation we are experiencing in 2022.

The FED then had to intervene and increase the FED rate, which increased the interest rates. This chain of events spread fear through the markets and contributed to aggressive selling and mass market exodus as investors turned to holding cash in fear of low growth and profit losses.

During this time many expected a rotation into bonds, however the bond market was moving in correlation with the stock market, which we do not see very often as the two tend to move in opposite directions.

Drop in Investor Confidence & Fear induced Selling

When pullbacks turn into corrections, fear settles in as the sentiment in the markets and investors confidence decreases. We see many start to pull cash out of the markets by selling their stocks, which often leads to decreased trading volume. This causes prices of securities to decrease.

In addition, when institutions and hedge funds decide to exit positions in large quantities, they cause aggressive selling and even larger drops in price. Usually the retail investors follow, start panicking and selling their shares, which further drops the prices.

Many are also forced to sell due to Margin Calls as they over-allocated their capital positions. This compounding selling causes a chain reaction that can cause bear markets. It’s kind of like adding fuel to the flame with each of these events.

We saw this at the end of 2021 and most of 2022 to date. This is likely why the NASDAQ went into the bear market, SPX quickly dipped into it and DOW JONES is only a few percentage points from the threshold.

Recognizing Bear Market Indicators

Being proactive means recognizing early indicators of a potential bear market. Look for:

- Declining economic indicators such as rising unemployment, lower GDP growth, and diminishing corporate profits.

- Increased interest rates and central banks shifting toward restrictive monetary policies.

- Market overvaluation and formation of speculative bubbles, especially within specific sectors such as technology or cryptocurrencies.

- Geopolitical instability or global crises creating significant economic uncertainty.

- Government intervention and regulatory changes negatively impacting market conditions and investor confidence.

Protecting Your Portfolio

To safeguard your investments, consider:

- Rotating into defensive sectors, including healthcare, consumer staples, and utilities, known for their resilience in adverse market conditions.

- Holding higher cash allocations or bonds, offering liquidity and relative safety.

- Implementing hedging strategies like put options and inverse ETFs to directly offset portfolio losses during downturns.

- Maintaining diversified holdings across various asset classes, geographic regions, and industries to minimize systemic risk.

Recent Examples of Bear Markets (Last Few Years)

- 2022 NASDAQ Bear Market: Driven by rapidly rising interest rates, significant corrections in technology stocks, and geopolitical instability resulting from Russia’s invasion of Ukraine.

- 2020 COVID-19 Bear Market: Global markets experienced sharp declines due to fears surrounding the pandemic, leading to significant economic disruptions and widespread uncertainty.

- 2018 U.S.-China Trade War Bear Market: Major indices like the S&P 500 and NASDAQ experienced over 20% declines amid concerns about escalating tariffs and disruptions to international trade.

Final Thoughts

While bear markets present undeniable challenges, they also offer significant opportunities for informed traders and investors. Remain calm, think strategically, and remember—every bear market eventually leads to a new bull market, creating new opportunities for wealth-building.

Thank you for reading, and until next time—happy trading!

-Bojan

It is important to know what happens during the bear markets and how to navigate them in order to come out on top and be profitable. This is why we created this bear market guide for you and hope we provided you with valuable information.

If you liked this guide, please subscribe and follow our YouTube channel for more great content. If you have any questions or comments, please feel free send us your feedback.

You can also like our page on social media or check out our website for professional investing and trading courses at icebergtrading.com

We hope that you enjoyed this guide, see you in the next one!